The Impact of CMS’ Evaluation & Management Code Changes on Pediatrics

September 25, 2018 | Featured Articles

The Centers for Medicare & Medicaid Services (CMS) recently proposed that the Work Relative Value Unit (wRVU) for 99201-99205 and 99213-99215 be the same in 2019.

Representatives from CMS claim the goal behind this effort is to reduce the documentation burden of providers. Yet applying the same value for each of these CPT codes undermines the foundation of the RVU system. This change also has the potential to create a negative impact on the financial bottom line for organizations that rely on RVU-based indicators to measure productivity and provide incentive bonuses for physicians.

One of several other potential consequences of this change is reduced access to subspecialty pediatric care for children—and additional burdens on general pediatric practices. Given the stakes for financial bottom lines and patient care, providers should take steps to weigh in with CMS on the impact this proposed change will have, and to prepare for the adoption and implementation of the proposed change.

The Current RVU Framework

The Health Care Financing Administration, predecessor of the Centers for Medicare and Medicaid Services (CMS), established the Resource Based Relative Value System (RBRVS) in 1992. This system assigns a relative value unit, or RVU, to services rendered by a physician for a patient. There are three components of RVUs:

- Work: This number is supposed to represent a provider’s compensation related to the estimated time spent with the patient, plus the education and skills necessary to complete a given procedure;

- Practice expenses: This number represents a practice’s estimated cost to provide a service, including rent, clinical salaries, and utilities; and

- Malpractice: The estimated cost for medical liability insurance on a “per-procedure” basis.

In theory, this is a point system allowing providers to be paid a proportional amount whether they are doing an aortic valve replacement or a level-3, established Evaluation & Management (E&M) visit. By assigning different values to reflect the physician’s expertise, level of decision making, technical acumen needed to provide the service, and cost to provide the service, RVUs help to normalize payments for different services and procedures in health care while also considering the varying levels of effort, expertise, and risk associated with different types of medical care.

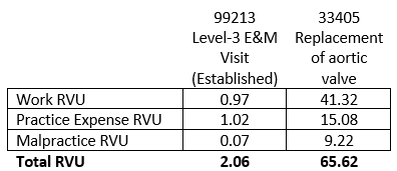

Comparing the RVU analysis for a level-3 established patient E&M visit with that of an aortic valve replacement using the 2018 national Medicare fee schedule illustrates the point:

Figure 1:

Under this established, RVU system, the estimated physician’s training, cost and skill required to perform an aortic valve replacement is 31 times greater than that needed to treat a child requiring an expanded assessment with low to moderate severity.

While the RVU system is not without its faults, caution should be exercised when abruptly changing the individual values of a collection of CPT codes. Such values are normally evaluated by a group referred to as the “RVC Update Committee,” or “RUC,” which extensively studies each code before assigning or adjusting its relative value components. While CMS reserves the right to determine the final RVU values assigned to CPT codes, consideration should be given to the precedent that assigning a collection of CPT codes the same values would set; and the extent to which this would open the door to additional scrutiny of this vital instrument that sets pricing for much of the US healthcare system.

Proposed RVU changes

The specific language of CMS’s proposed RVU changes includes the following:

“To improve payment accuracy and simplify documentation, we propose new, single-blended payment rates for new and established patients for office/outpatient E/M level 2 through 5 visits and a series of add-on codes to reflect resources involved in furnishing primary care and non-procedural specialty generally recognized services.”

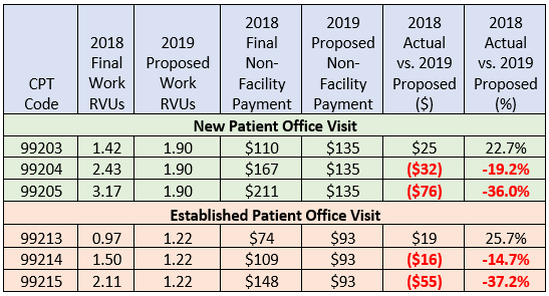

Practically speaking, CMS proposes to pay the same rates for 99202-99205 ($135) and 99212-99215 ($93), instead of the differential payment rates currently in use.

Figure 2:

Financial Impact

While the 99201, 99202, 99203, 99211, 99212, and 99213 CPT codes will see an increased payment rate, providers billing a high percentage of 99204, 99205, 99214, and 99215 should expect a revenue decrease. On a line-by-line basis, 99213 will see an increase of more than 25 percent. Meanwhile, 99214 and 99215 will see a decrease of 14.7 percent and 37.2 percent, respectively. Since the Medicare Fee Schedule is the gold standard by which to set state Medicaid payment rates, these changes in E&M code rates will trickle down to practices almost immediately.

Practices with few to zero Medicaid patients will feel the pinch as every insurance company bases its contractual, allowed amount on a percent of Medicare.

Regardless of the number of Medicaid patients in a Pediatric practice, CMS’ proposed change has the potential to adversely affect the financial stability of Pediatric practices.

Scenarios

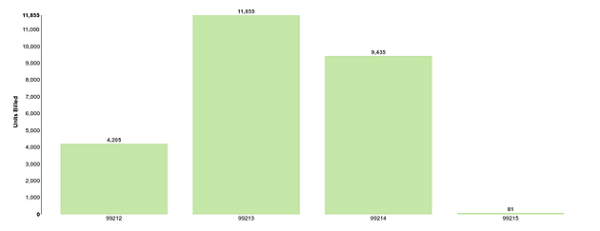

It is not uncommon for a general pediatric practice to have an E&M distribution like this:

Figure 3:

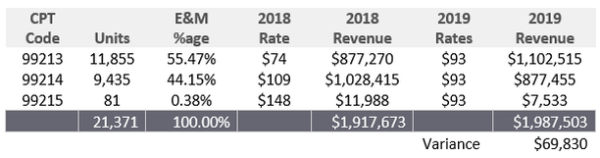

While much can be said about the practice with the distribution displayed above, this is a common pattern seen when PMI is called in to evaluate a practice. Based on CMS’ proposed rates, this practice with a heavy emphasis on 99213 could see a potential increase in revenue:

Figure 4:

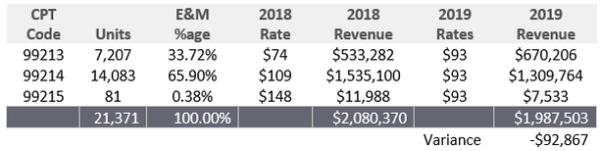

A practice with the same number of visits (21,371) but higher percent of 99214/5 codes should plan to experience a decrease in payments:

Figure 5:

As one can see, the impact of CMS’ proposed rate changes will influence practices’ bottom lines to varying degrees based on an individual practice’s E&M distribution. The only way to measure the impact your own practice may experience is to run a similar analysis. Practices that historically rely heavily on 99213 are expected to see an increase; while practices coding at higher levels (more 99204, 99205, 99214, and 99215), should brace for decreases in revenue.

This illustrated reduction of more than $92,000 cannot be offset by any decrease in overhead cost, as this analysis examines only the individual CPT codes involved and not the entire visit. Such payment reductions can only be offset by a reduction in provider compensation or an increase in hospital subsidies (if available to employed providers).

Impact on Mental Health Care

Since the payment for treating a runny nose or dealing with a child with mental health issues will be given the same weight (and the same payment rate), it is clear that the proposed change could adversely affect a provider’s willingness to spend the time necessary to address such concerns.

While most, if not all, of PMI’s clients would never let a child’s mental health needs go unattended, the real focus come down to adequate compensation for taking the necessary time to help the child/family facing mental health issues. Under CMS’ proposed change, they are advocating that the provider be paid the same for treating simple concerns versus taking the time necessary to address mental health issues. PMI believes that CMS’ declared intention to “reduce the documentation burden of providers” poses additional unintended consequences that need to be fully evaluated before the proposed changes are finalized.

Implications for Pediatric Subspecialists

Many pediatric subspecialists will see a greater impact on financial performance, following Medicare’s decision to stop paying consultation codes (99241-99245 and 99251-99255) for Medicaid patients due to varying state Medicaid payment policies.

Subspecialists are not able to bill the consultation codes for Medicaid patients in many states across the country. As such, they are relegated to using the 99214/99215 codes for such patients (appropriate, based on current CPT guidelines). The squeeze comes when these subspecialists are faced with a 37.2-percent reduction in their “bread and butter” codes for consultations (99215) and have a high percentage of Medicaid patients, which is perfectly normal.

PMI finds it very difficult to see how large pediatric academic centers with a high percentage of Medicaid patients in states that do not pay for consultation codes will be able to continue to adequately pay such providers for their time and effort to care for children without additional hospital subsidies or a reduction in provider salaries.

The unintended consequence of CMS’ proposal points to a potential reduction in access to subspecialty care for children in various regions of the United States. For example, if Acme Children’s Hospital in Anywhere, USA, employs many pediatric subspecialists that routinely rely on 99215 to bill for their services, the projected reduction of more than 37 percent related to this code for Medicaid patients is sure to have a negative effect on financials. Aside from seasoned subspecialists being pushed into retirement because of this financial reality, PMI expects acceptance of CMS’ proposal will lead to further reductions in access to subspecialty care.

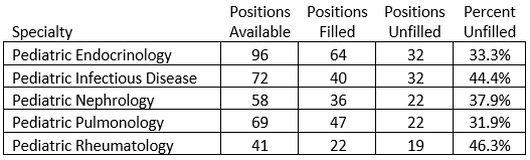

Additional pressure on subspecialty care can be seen when looking at Resident Match Program results released in December of 2017:

Figure 6:

As the data indicates, there are fewer people going into key subspecialty areas of pediatrics than are needed. The reduction in financial stability for subspecialists further decreases the likelihood of future candidates continuing their educations for an additional three years—only to find compensation has decreased while student loan obligations continue to rise.

Physicians, hospitals and academic centers only have a few options to address the issue. Each response brings residual effects on other aspects of financial operations:

- Hospitals can find ways to increase subsidies for employed, subspecialty providers in order to offset costs allocated to their “cost centers,” thereby allowing more funds to flow through to the bottom line and to support provider compensation/benefits;

- Academic centers can shift funds from within their respective practice plans to support the communal good of ensuring appropriate levels of compensation for all providers within the institution; or

- Physicians, if the salaries cannot be protected in some way, may move away from a given region to join a larger institution in areas that are financially favorable.

While there may be additional ways to address potential impacts to subspecialty pediatricians, the point remains the same: the financial impact from CMS’ proposal is certainly going to be painful for subspecialty care and could lead to additional shortages of access to subspecialty care within various regions across the country, thereby increasing demand on general pediatric practices.

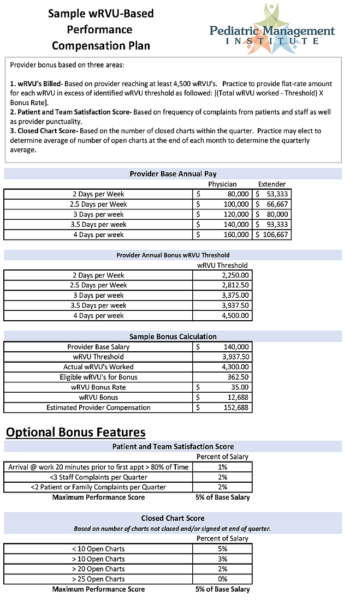

Implications for RVU-Incentive Contracts

Hospitals and practices interested in offering production incentives to physicians utilize a wRVU-based formula because it provides an incentive for the work actually being done with no regard for payments received for services rendered. This is particularly popular with organizations that have providers care for disproportionate percentages of Medicaid patients.

A typical wRVU bonus incentive may look something like this:

Figure 7:

CMS’ proposed changes in wRVU won’t nullify the applicability of wRVU-incentive bonuses. That said, the changes will require physicians, practices and organizations to re-evaluate numbers so providers have reasonable chances of earning bonuses.

Providers are not likely to earn bonuses if employers simply leave existing contracts alone with the same threshold (number of wRVUs needed to earn a bonus), given the proposed reduction in values for 99204, 99214, 99205 and 99215.

Future Contract Thresholds Will Need To Be Re-Calibrated

Aside from the obvious problems that arise from comparing a provider’s RVU productivity for 2019 to any previous year(s), there are several issues practices and providers need to bear in mind if CMS’ proposal is accepted as written.

- For providers currently receiving a base salary plus bonus payment for billing more than a specified number of wRVUs, care must be taken to address how an employer plans to account for the impact of CMS’ proposal. If a provider currently has a high percent of 99214 and 99215s, they should not expect to reach the same number of wRVUs in 2019. As such, the incentive threshold needs to be adjusted in the contract to set a reasonable expectation in terms of provider productivity.

- PMI recommends that any providers seeking employment from a hospital or practice with such a bonus arrangement consider requesting that the contract state the wRVUs are to be based on the 2018 wRVU values. If a contract is silent on the issue, it is best to clarify the employer’s intention in advance.

- For practices and hospitals seeking to offer or renew RVU-based incentives, care should be taken to account for the proposed change in wRVU values. Determining the appropriate bonus rate to be paid for each wRVU above a specific threshold can be challenging under the best of circumstances. If practices are unable to build the proper models to evaluate the financial impact of offering an RVU-based incentive, they run the risk of either jeopardizing a practice’s financials or not being able to compete with production incentives other employers offer. The proposed changes may simply be too much, and consideration of an incentive based on charges or payments generated may be in order. PMI notes, however, that this may conflict with a variety of philosophical approaches and may undermine the idea of ACO’s, MIPS and MACRA.

For practices looking to consider performance incentive bonuses based on revenue generated, check out PMI’s online calculator to help guide you on such efforts by clicking here.

Call To Action

Considering the potential impact of CMS’s proposed RVU changes, PMI recommends that providers take a few important steps.

First, providers can weigh in with CMS. The proposed changes are not yet finalized, and provider perspectives may help to prevent the rule’s implementation or persuade CMS to modify the proposed language. You can weigh in with CMS in a variety of ways:

1. Contact your state chapter of the American Academy of Pediatrics (AAP) to see what efforts are underway to bring attention to this issue. Taking advantage of this opportunity to speak as a unified voice lends credence to your voice and adds value to being a supporter and member of your state AAP chapter.

2. Contact your federal representative or senator to educate them on the impact CMS’ proposal will have on pediatrics, particularly subspecialty care. Depending on the financial stability of subspecialty employers, there could be potential access-to-care issues for their most vulnerable constituents.

3. Contact state medical directors to share your thoughts. These professionals have significant influence over payment policies of the organizations they work for.

Second, you should prepare now for implementation of the proposed changes. This includes reviewing managed-care contracts to determine whether payment rates are based on the current year’s Medicare rates/values. It is not uncommon for some insurance companies to pay a percentage of the current year’s Medicare rates while others will specify in the contract the year of Medicare rates they intend to pay. For the practices that have contracts specifying the allowed amounts as X percent of the 2018 fee schedule, you should not see any change for that payer. For practices with contracts with X percent of a given current year’s Medicare rates, you can expect to see a decrease in revenue if you use 99204, 99205, 99214 and 99215 extensively.

While CMS is in a difficult position of trying to satisfy many competing interests, this effort is clearly not the way to address the “documentation burden” of physicians. If CMS continues down this path as proposed, pediatric practices will face even greater pressure to squeeze out operational efficiency or reduce provider compensation.

If your practice needs any assistance identifying opportunities to improve your financial performance, take a look at http://www.PediatricSupport.com or reach out to us to discuss how we can help.

__

__

[1] https://www.acc.org/latest-in-cardiology/articles/2018/07/12/18/19/cms-releases-proposed-2019-medicare-physician-fee-schedule

[2] https://www.healthdatamanagement.com/news/seema-verma-tells-docs-cms-will-reduce-ehr-documentation-burdens

[3] While many readers may take issue with whether various values assigned to different components of these specific codes, for now, the focus of this example should be to visualize the relationship of the three components that make up the total RVU value.

[4] https://www.ama-assn.org/rvs-update-committee-ruc

[5] https://www.cms.gov/newsroom/fact-sheets/proposed-policy-payment-and-quality-provisions-changes-medicare-physician-fee-schedule-calendar-year-3

[6] Sample practice using IntelliTraq business intelligence solution to monitor their practice financials. The system currently analyzes over 4 million encounters to help pediatricians understand their financial data from Office Practicum, Allscripts, Greenway, eCW, Athena, Epic and several other systems.

[7] It should be noted that the expected increases to 99201,99202, 99211 and 99212 have been set aside in the analysis above since most readers of this article rarely, if ever, use such codes. When evaluating the practice’s entire revenue generation, the increases to these four codes should offset some of the variance in Figure 5. However, when evaluating the individual provider’s RVU-based incentive bonuses and the ability to generate enough income to cover their salary, benefits and cost to provide care, the CPT codes in Figure 4 and Figure 5 should be given stronger weight.

[8] https://www.texmed.org/Template.aspx?id=8285

[9] http://www.nrmp.org/wp-content/uploads/2017/12/Pediatric-Specialties-Fall-Match-Results-Statistics-AY2018.pdf

[10] https://www.federalregister.gov/documents/2018/07/27/2018-14985/medicare-program-revisions-to-payment-policies-under-the-physician-fee-schedule-and-other-revisions